The Biden Administration has begun to move in earnest to draft and pass new tax legislation that could dramatically affect the giving landscape in America. Though we do not expect new legislation to pass until the fall, it is important for fundraisers to pay attention to the proposals. Biden’s proposed changes may affect how your donors plan their charitable giving. This article provides an overview of the potential implications of tax reform on charitable giving, along with guidance for fundraisers looking to discuss these matters with their donors.

How Proposed Tax Policy Changes May Affect Donations to Nonprofits

The tax policy proposals contained in President Joe Biden’s American Families Plan and Made in America Tax Plan, along with Senator Bernie Sanders’ proposed For the 99.5% Act, have made headlines in recent weeks. There isn’t one quick answer for how these tax proposals will affect donations to nonprofits.

On one hand, higher taxes lead to less cash on hand to donate. The Biden Administration’s proposals would raise income and capital gains taxes on American taxpayers making more than $400,000 per year.

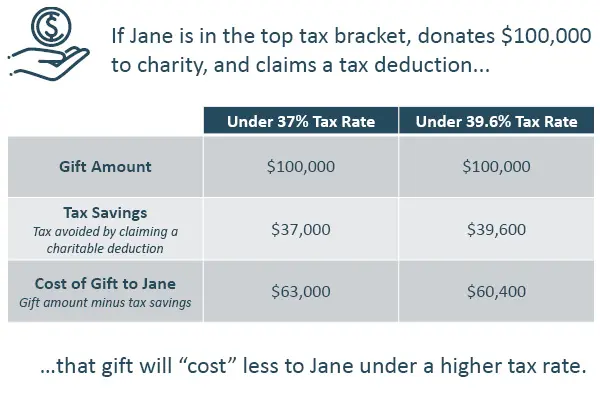

On the other hand, the incentive to give increases as tax rates rise. When tax rates go up, charitable giving becomes more attractive since it often allows donors to reduce the amount of taxes they will pay. The illustration below demonstrates how charitable giving becomes more tax-efficient or “cheaper” for wealthy donors after an income tax increase.

Complicating this is the fact that during his 2020 presidential campaign, President Biden expressed support for limiting charitable deductions such that taxpayers making more than $400,000 per year could only deduct to a rate of 28% (as opposed to 39.6%). This would mean that in the example above, Jane could only save $28,000 in taxes rather than $39,600.

However, the 28-percent-cap provision did not appear in the White House’s American Families Plan released in April 2021. Amid uncertainty as to whether this 28-percent-cap could show up in future legislation, Dan Cardinali, CEO of Independent Sector, stated that the national coalition of charities and foundations “will continue to urge policymakers to exclude the charitable deduction from any future efforts to introduce caps on itemized deductions.”

In addition, the estate tax changes proposed in Senator Sanders’ For the 99.5% Act would make more estates eligible to be taxed and increase estate tax rates. These measures might encourage donors to give by bequest or deploy other gift planning vehicles to avoid paying new estate taxes.

How Big of an Influence Does Tax Policy Have on Giving?

Tax savings are more of an incentive than a motivator for charitable giving. Individuals give to charity for complex and unique reasons. Decades of academic studies and historical tax data show that donors respond to incentives like the ability to itemize charitable deductions.[1] Yet research also suggests that donors are primarily motivated to give by an organization’s mission and impact.

CCS has interviewed thousands of donors in feasibility studies since 2011. In more than 20,000 of these interviews, CCS asked about the donor’s overall motivations for donating to charity. Donors most frequently cited that they are motivated by the impact of their gift and by a belief in helping others. Receiving an income tax deduction was the least frequently cited motivator for giving.

Similarly, the U.S. Trust Study of High Net Worth Philanthropy found that among wealthy donors, tax benefits ranked tenth on a list of 15 factors for making charitable decisions. Only 17% of donors said they always consider tax benefits when making charitable decisions.

Going forward, it will be interesting to see how individual giving rates are influenced by the universal charitable deduction of $300 available to all taxpayers in 2020 and 2021 as a result of the CARES Act. For now, we know that tax incentives do influence a sizeable portion of donors, but that they are far from the most common motivator for charitable giving.

Some sectors and gift types are more likely to experience volatility with the shifting tax landscape. Dr. Russell James III, a Texas Tech University Professor, found cash gifts to education are two times more responsive to tax price compared to cash gifts to religion. In addition, gifts of stocks are ten times more responsive to tax price than cash gifts to education.

Donor Relations Amid the Uncertainty

Many professional advisors estimate that Congress will finalize tax reform legislation this fall. In preparation for the proposed changes to the tax code, nonprofits can and should begin talking with donors about how the changes affect donors’ considerations for making a gift.

In a climate of uncertainty around tax policy changes, we advise fundraising professionals to:

- Read. Tax changes will be well covered by the media. Stay apprised of policy news via nonprofit-focused organizations like the Chronicle of Philanthropy, Independent Sector, and National Council of Nonprofits; national newspapers; and tax policy think tanks.

- Consider building a relationship with professional advisors to help with more complex giving situations. Nonprofit professionals do not need to be tax or legal experts, and in fact, cannot offer direction on either topic. By working with professional advisors like estate attorneys and financial planners, fundraisers can develop a high-level understanding and equip themselves with the vocabulary to recognize and suggest ideas that the donor might bring to their own tax and estate attorneys.

- Educate donors on gift planning vehicles. What assets and which vehicles to use to make a gift matter. Think beyond cash gifts to assets like stocks, real estate, business interests, or giving vehicles such as charitable trusts, annuities, and bequests. You can help a donor save enormous sums of money by pointing them to the correct combinations.

- Always keep your mission front and center. Tax incentives influence donors’ giving plans and can drive urgency and action when policy changes are on the horizon. Still, it is important to keep in mind that donors give for many interconnected reasons and tax benefits are often not their primary motivator. Center the giving conversation on the difference that the donor’s gift will make to your mission.

Notes

[1] For historical information on tax incentives’ influence on charitable giving, see these resources recommended by the Giving USA Foundation: Charles Clotfelter, Federal Tax Policy and Charitable Giving, University of Chicago Press, 1985; Charles Clotfelter, “The Impact of Tax Reform on Charitable Giving: A 1989 Perspective,” National Bureau of Economic Research Working Papers, 3273, https://ideas.repec.org/p/nbr/nberwo/3273.html; John Peloza and Piers Steel, “The price elasticities of charitable contributions: a meta-analysis,” Journal of Public Policy & Marketing, 2005, 24(2), 260-272; Gerald E. Auten, Holger Sieg, and Charles T. Clotfelter, “Charitable Giving, income, and taxes: An analysis of panel data,” The American Economic Review, 2002, 92(1), 371-382; Richard Steinberg, “Taxes and giving: New findings,” Voluntas: International Journal of Voluntary and Nonprofit Organizations, 1990, 1(2), 61-79; Christoper Duquette, Is charitable giving by nonitemizers responsive to tax incentives? New evidence,” National Tax Journal, 1999, 195-206; Nicholas Duquette, “Do tax incentives affect charitable contributions? Evidence from public charities’ reported revenues. Journal of public economics, 2016, 137, 51-69.

Sources

We are grateful to the following sources used to inform this article and the accompanying briefing.

- Arkansas Community Foundation, “Charitable Giving Projections for 2021 under President Biden’s Proposed Tax Plan” (N.d.)

- Baker Hostetler, “2021 Tax Reform Expected to Be Substantial and Far-Reaching” (April 14, 2021)

- Chronicle of Philanthropy, “Biden Plan Would Aid People in Poverty and Nonprofits That Serve Them” (April 29, 2021)

- Davis Wright Tremaine LLP, “No Time Like the Present: Estate Planning Strategies for Potential Changes in 2021 and Beyond” (May 4, 2021)

- Duke University, “3 (more) Biden tax proposals: Understanding potential changes to gift and estate taxes” (December 8, 2020)

- Duke University, “5 Biden tax proposals: Understanding potential changes to income and capital gains taxes” (November 19, 2020)

- Financial Advisor, “Preparing Charitable Clients for the Biden Tax Regime” (January 25, 2021)

- Goulston & Storrs PC, “Potential Individual Income & Transfer Tax Changes Under the New Administration” (May 12, 2021)

- Greenbaum, Rowe, Smith & Davis LLP, “Proposed “For The 99.5% Act” Could Bring Significant Changes To Existing Federal Estate, Gift And Trust Tax Rules” (April 30, 2021)

- K&L Gates LLP, “Proposed Federal Estate and Gift Tax Legislation” (April 5, 2021)

- Lasher Holzapfel Sperry & Ebberson PLLC, “Federal Estate Tax Legislative Update” (April 30, 2021)

- Lathrop GPM, “Spring 2021 Charitable Giving Update” (April 6, 2021)

- McManus & Associates, “Conference Call: Election Updates and How to Approach Estate Planning in 2021” (January 29, 2021)

- Moritt Hock & Hamroff LLP, “Estate & Gift Tax Update” (April 22, 2021)

- New York Times, “Biden Aides Quietly Say His Tax Increases Would Help Charities” (May 6, 2021)

- New York Times, “What’s in Biden’s Tax Plan?” (April 7, 2021 – Updated May 5, 2021)

- Northern Trust, Tax Policy Resources Center (N.d.)

- Perkins Coie, “Washington’s New 7% Capital Gains Tax Questions Answered” (May 3, 2021)

- Ruder Ware, “Proposed Gift and Estate Tax Changes Mean Some May Need to Act Now” (April 9, 2021)

- Tax Foundation, “Biden’s Proposed Capital Gains Tax Rate Would be Highest for Many in a Century” (April 26, 2021)

This piece has been prepared for informational purposes only and is not to be construed as tax advice. Individuals should consult their accountant or tax advisor with regard to such matters.